VC could be the key to European rearmament, but some big barriers stand in the way. DSEI Gateway speaks with a European VC defence firm to explore the challenges.

The war in Ukraine has caused a seismic shift in European defence and, with that, a seismic shift amongst European venture capital (VC) firms. Where VC investors once shied away from defence, wary of its ethical concerns, many now see an opportunity to help supply a rapidly rearming Europe.

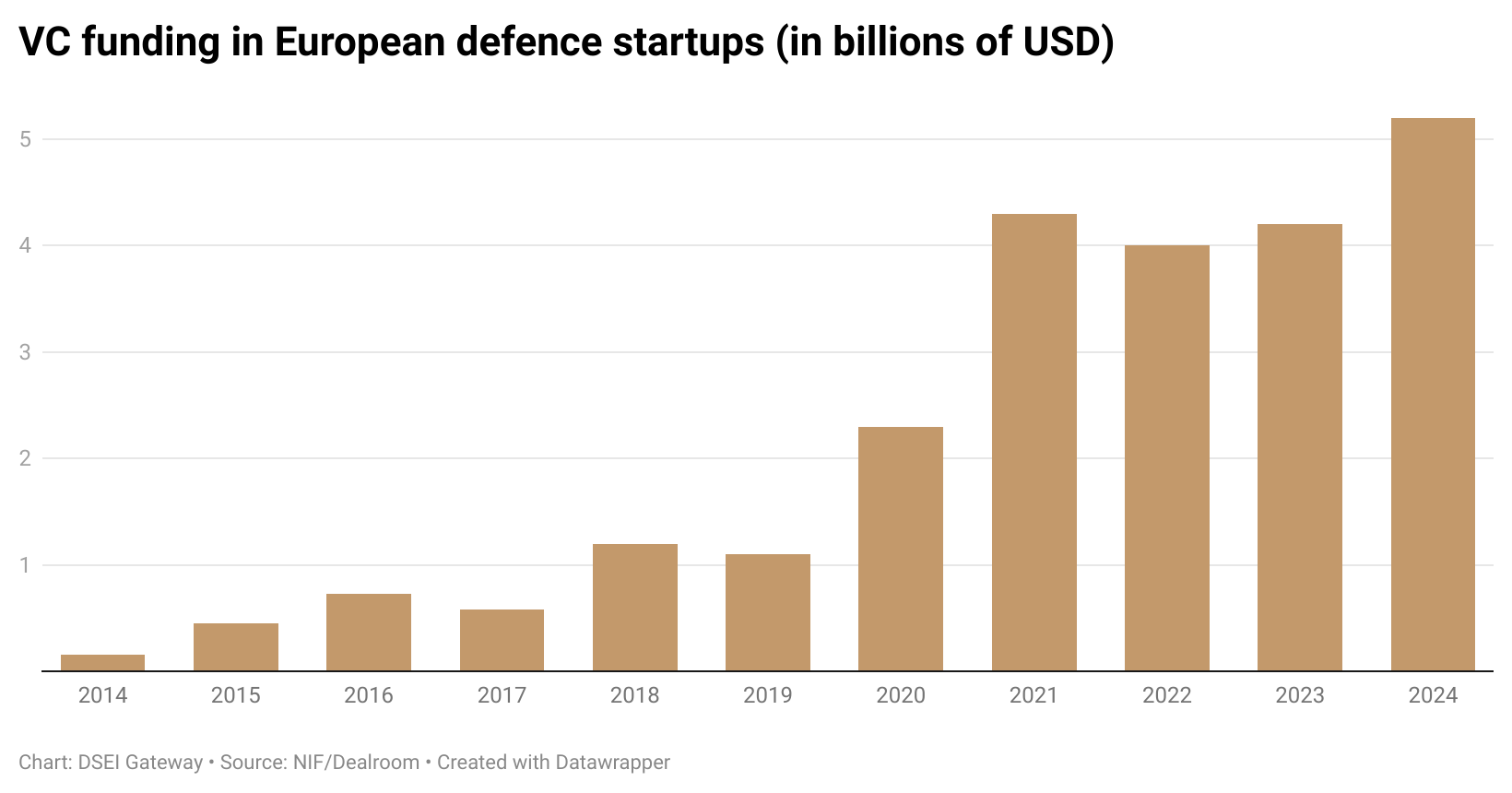

Research from the NATO Innovation Fund (NIF) and Dealroom, an investment database platform, recently found that VC funding in European defence and security tech has risen by 30% over the last two years to USD5.2 billion. According to NIF’s vice-chairwoman, Dame Fiona Murray, this speaks to a new sense of defence investment as “ethically positive and important”.

“I personally think that it’s a shift [caused by] Ukraine and also a recognition that we are in much, much more complex geopolitical times”, Murray said, according to reporting from The Telegraph.

What role do VCs play?

Defence is a challenging sector for innovators and startups, particularly financially. The industry's infamously lengthy procurement cycles create a ‘valley of death’, which is the time it takes for an initial concept to deliver a return on investment (ROI).

Many startups are not used to navigating such time-consuming processes and lack the financial infrastructure to see them through several years of procurement process without ROI. Financial backing from VC companies can help firms stay profitable while navigating this complex and lengthy period.

One firm offering such financial backing is Darkstar, a European-based VC fund that focuses solely on defence tech investment. DSEI Gateway sat down with one of the firm’s founders, Ragnar Sass, who explained that private capital is crucial to every defence startup.

“Any defence company has to be super laser focused to not only get investment capital, but also [get] government grants”, Sass said.

“Being extremely honest here, even the most advanced governments are struggling to move from peacetime reality to wartime reality. We have to do way more and, being extremely frank here, we cannot fully only rely on the government”, Sass said.

An uphill battle for defence investors

Despite increasing enthusiasm, though, private capital in defence has its challenges, perhaps unsurprisingly after years of hesitancy.

One challenge is in navigating the gap between legacy military systems and the newer technology smaller defence firms develop.

Investors “need to be sure” that established, legacy systems can support the technology that startup firms are developing, this can make it challenging for VCs to understand where to invest.

Ageing technology is often a symptom of organisations in the public sector and can be difficult for innovative startups to work with. This is because legacy military equipment is often vendor-locked to a specific company and built on closed, proprietary hardware and or software that is not designed to ‘talk’ to external systems.

While European militaries continue to rely on legacy equipment and face slow procurement cycles for new equipment, Ukraine is acquiring and deploying at pace. VCs find that Ukraine operates and behaves “like a startup”, buying and deploying technology in “a matter of weeks”, compared with two or so years for Europe, Sass emphasised.

Investors, in turn, find themselves “connecting two worlds” between fast operating speeds in Ukraine and lengthy procurement models and legacy equipment in Europe, he added.

Adding to this, Sass said VC companies entering defence need to understand “how complex and slow” the system is in Europe, Sass said. Only with that knowledge are these firms likely to overcome key problems.

“You have very slow phase cycles and so on – be very realistic on that, and plan for that”, Sass said.

While it’s clear VCs have an important role to play in rearming Europe, the government also holds a significant position. Sass said there is no “easy” answer to the question of whether governments in Europe are doing enough to prepare the defence ecosystem, though.

The tech community needs to be involved as well, Sass concluded, as only those with a tech background understand the speed that the defence industry needs to move at. Similarly, armed forces reform is necessary to make militaries “way more innovative” and able to adapt to new weapons systems in a matter of months.

It’s clear there is no silver bullet for ensuring the success of European rearmament, but with VCs increasingly getting involved in the sector and new defence-focused funds emerging, the defence industry looks set to benefit from a new wave of innovation-led investment.

DSEI Gateway News is part of DSEI UK and the broader Clarion Defence portfolio.

Enjoy reading this article? Click here to read more about our upcoming DSEI membership offering...

Tags

- according

- barriers

- big

- capital

- caused

- defence

- dsei

- equipment

- europe

- european

- europes

- financial

- firm

- firms

- gateway

- investment

- investors

- key

- legacy

- more

- new

- pitfalls

- private

- procurement

- promise

- rearmament

- sass

- seismic

- shift

- speaks

- stand

- systems

- tech

- technology

- ukraine

- vc

- vcs

- venture

- way

- years

Providing impartial insights and news on defence, focusing on actionable opportunities.

-

It marks a major step-change in Canada’s approach to defence procurement.

-

It comes as the company announces its first dual-use spin-out.

-

Most of those competing are US-based small businesses.

)

)