Venture capital firms are key to driving the rearming of Europe. DSEI Gateway speaks with these key stakeholders to understand their strategies.

Russia’s war in Ukraine and the US administration are reshaping European security and prompting countries across the continent to rearm and accelerate their equipment programmes.

Private investors are seen as integral to supporting this rearmament, particularly in fostering the development of novel military and dual-use technologies from the small and medium-sized enterprise (SME) and startup community – technology increasingly vital to governments and military forces.

“Europe’s defence SMEs and dual-use start-ups are seeing accelerated momentum, driven by shifting geopolitical dynamics, growing emphasis on EU strategic autonomy, and rising defence budgets across member states,” Loredana Muharremi, a Morningstar equity analyst told DSEI Gateway.

Altogether, there are 420 aerospace and defence startups operating in Europe, with a noticeable uptick of companies forming since 2018, Muharremi highlighted. Approximately 30% of these ventures were established in 2022 or later, indicating a substantial recent surge in activity within the sector.

In terms of venture capital (VC) and private equity funding by region, Morningstar’s data reveals that this is concentrated primarily in France, Germany, the Nordic regions (particularly Finland), and Spain.

While there are different options for start-ups and SMEs seeking funding in Europe, such as through grants from the European Defence Fund and the NATO Innovation Fund, their development is largely contingent upon private funding.

VC firms, in particular, are increasingly interested in this domain, with firms acquiring equity stakes in companies in exchange for capital investment and developmental support.

Software-first future

One VC firm that is helping drive innovation in defence is UK-based Air Street Capital, which has two defence-focused portfolio companies in Europe.

These are Greece-based Delian, which specialises in autonomy, electronic warfare (EW) and rapid manufacturing; and Swedish firm Polar Mist Technologies, which concentrates on autonomous maritime technology.

The founder of Air Street Capital Nathan Benaich told DSEI Gateway that his firm focuses on small companies that combine AI and commercial hardware to deliver cutting-edge capabilities that were once only found in expensive, exquisite systems.

For example, Delian’s drone-based GPS-denied navigation software allows even cheap drones to become secure capabilities, once reserved for advanced and expensive weapons systems, he said.

Investing and developing this kind of technology is important for the company because most military capabilities are not currently built to meet the demands of the future, characterised by being software-first, autonomous, low cost, and in mass, Benaich said.

He also pointed to the ReArm Europe defence-focused plan from the European Commission, published in March, aimed at boosting defence spending. “We see a huge need and willingness to build up Europe's defences and are optimistic that sizable budgets will be granted to new players vs. incumbent primes, particularly on capabilities relating to autonomy.”

While it is encouraging that European countries are beginning to realise the scale of the threat, Benaich said money is not enough. “There needs to be significant changes to procurement – in terms of its speed, the companies engaged with, and the types of systems bought.”

Ukraine Innovation

Ukraine has emerged as a hotbed for innovation, driven by necessity. It has also attracted the attention of VC firms.

US-based VC firm Green Flag Ventures focuses specifically on growing this innovation in Ukraine, specialising in dual-use, defence, AI and cyber startups, noted Justin Zeefe, the founding partner while speaking with DSEI Gateway. It also considers startups in other frontline Eastern European countries facing similar strategic pressures, he added.

Green Flag Ventures’ current portfolio of companies include Himera, a tactical communications specialist developing encrypted mesh radios and headsets; Kara Dag Technologies, which produces low-cost, modular counter-uncrewed aircraft systems (C-UAS) and EW systems proven in Ukraine; and Swarmer, which develops software to enable smart autonomous drones to operate in coordinated teams.

Founder of Himera, Mykhailo Rudominskyi (left), and Justin Zeefe (centre) and Deborah Fairlamb (right), founding partners at Green Flag Ventures.

Three more deals are in the final stages, Zeefe said, with the names set to be announced in 2025.

Ukraine’s appeal for defence tech investors is rooted in four key advantages, he added.

Firstly, Ukraine is producing combat-proven innovation, acting as the world’s largest defence tech lab. The country also has significant talent and technical depth, producing more than 30,000 tech graduates per year and a pool of more than 300,000 active highly skilled professionals.

Additionally, he highlighted the dual-use focus of many of Ukraine’s companies, along with strategic alignment with other European nations, such as the Baltics, Poland, the Nordics, and Romania. “Many Ukrainian dual-use firms are already selling into NATO-aligned markets, offering deployable solutions that fill critical procurement gaps in drones, EW, cyber, and ISR [intelligence, surveillance, and reconnaissance]”.

Ukraine has also completely redefined contemporary warfare. “Nations are shifting from buying high-end, one-size-fits-all platforms to networked, flexible systems that can be deployed at scale,” Zeefe concluded.

Fostering innovation

Many VC investors see defence as a burgeoning source of entrepreneurial talent.

Bruno Raillard, co-founder and partner of France-based VC firm Frst Capital, emphasised this to DSEI Gateway, stating that his firm prioritises identifying ambitious founders over focusing on specific niche markets.

His firm has increasingly pivoted towards defence technology because of “a view of the direction of travel in the world”, not just in terms of geopolitical realities but the potential of technologies such as AI.

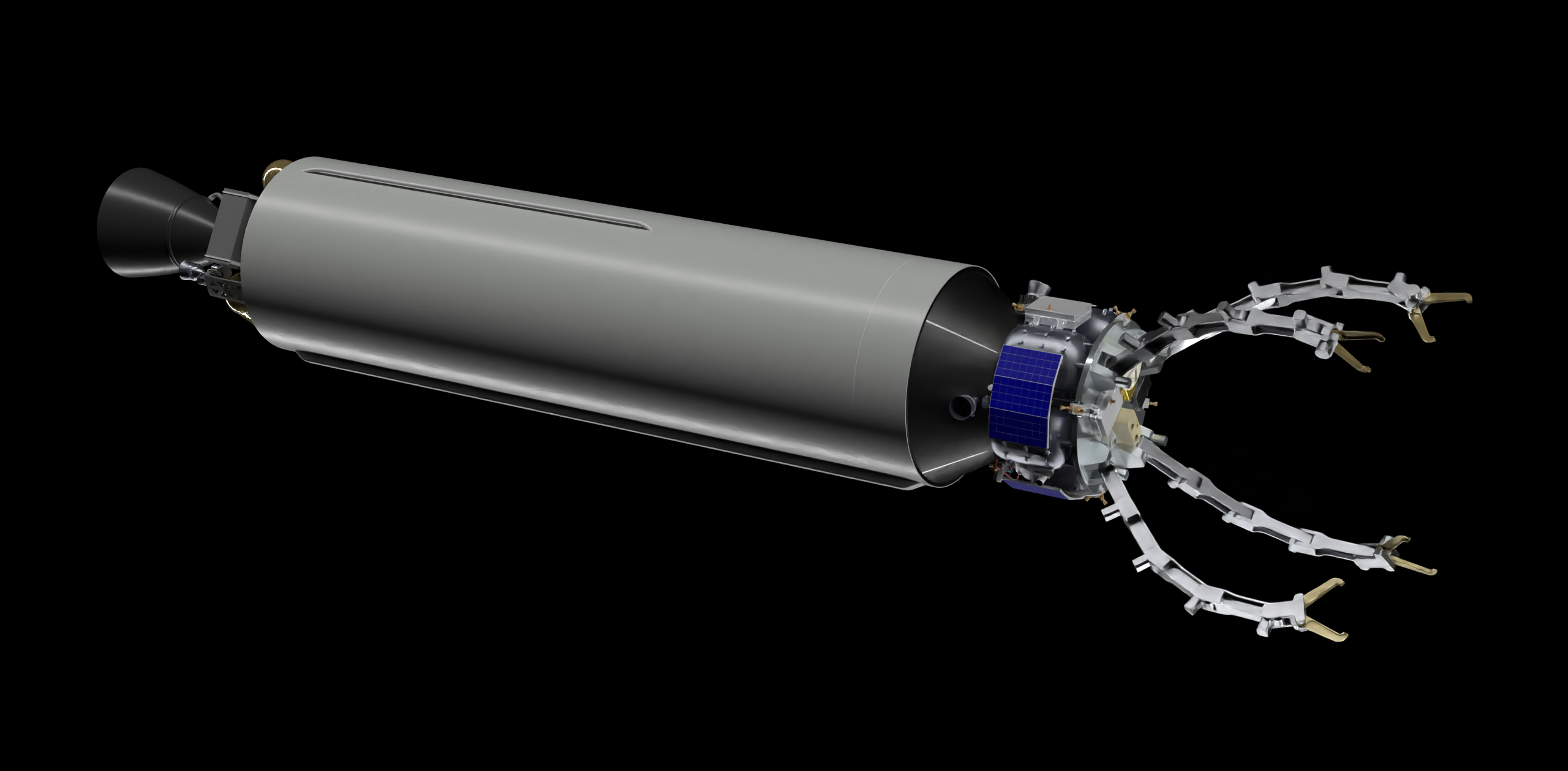

Frst Capital has mainly invested in French companies to date, though Raillard said it is open to investment opportunities in other European countries, such as the UK and Nordic nations. One of its major defence investments is Dark, which is developing interceptor technology to address space-based threats in low Earth orbit.

An illustration of the interceptor technology being developed by Dark to address threats in LEO. (Dark)

New players are entering the defence VC space as well. For example, Defence Invest is an emerging specialised VC firm that is currently raising a fund to invest in European early ‘Series A’ stage defence tech startups, with Series A being the first significant round of funding after the initial ‘seed’ stage.

The firm was founded by First Lieutenant Matt Kuppers and Colonel Dr Jörg Wissdorf, who previously served together as full time reservists in the German military.

The EUR50 million fund is focused on the uncrewed sector, from ground, aerial to undersea vehicles, and its associated software because “they are easy to deploy, easy to scale, and have a lot of versatility”, Kuppers told DSEI Gateway. Defence Invest focuses on providing funding as well as consulting services, introductions to defence industry primes, and more.

A clash of cultures

Since putting out a call for innovators to submit their ideas in April 2025, the company has had submissions from around 50 startups looking for funding, he said. In addition, they have had conversations with governmental organisations and potential limited partners interested in investing in the venture capital firm.

For Wissdorf, who also spoke to DSEI Gateway, the aim is to overcome a “clash of cultures” between large military organisations on one hand and engineers and founders on the startup side. “It is very important to bring both sides together and help them to understand each other.”

The challenge

There is a need for significant private investment in defence-focused SMEs in the coming years, Morningstar’s Muharremi concluded.

Near-term funding is likely to be catalysed by EU programmes like the European Defence Fund and the work of the Directorate-General for Defence Industry and Space.

Nevertheless, as many European countries continue to struggle financially, VC firms and the private sector must become more integrated into the sector to help fund the expansion of innovative startups and SMEs. The coming years will demonstrate if Europe can find the right mix of regulatory reform and commercial innovation to develop a vibrant landscape.

DSEI Gateway News is part of DSEI UK and the broader Clarion Defence portfolio.

Enjoy reading this article? Click here to read more about our upcoming DSEI membership offering...

Tags

- capital

- companies

- countries

- defence

- dsei

- dualuse

- europe

- european

- europes

- firm

- firms

- fund

- funding

- gateway

- innovation

- investors

- key

- military

- more

- poised

- smes

- startups

- support

- systems

- technology

- ukraine

- vc

Providing impartial insights and news on defence, focusing on actionable opportunities.

-

The fund specifically targets small, UK-owned companies that are new to defence.

-

The system could revolutionise tactical operations.

-

The marketplace follows the establishment of the new small C-UAS JIATF-401 taskforce last year.

)

)

)