The commercial space sector is crucial to boosting the UK military’s space capabilities. DSEI Gateway speaks to two companies supporting this.

Space is essential, underpinning modern daily life and serving as a critical enabler for militaries. Disruption to GPS alone could cost the UK economy GBP1 billion a day.

Considering this, the UK is seeking to bolster its satellite communications, situational awareness, and navigation systems in space to ensure freedom of navigation and connect its 'integrated force'.

Dual-use technology is seen as integral to this. This was reiterated in the UK’s Strategic Defence Review (SDR), published in June and written by three leading defence experts, which urged the government to “maximise the synergies between the UK civil space sector and clear military needs”.

Capitalising on this demand, commercial space companies are actively involved in supporting some of the UK Ministry of Defence’s (MoD’s) largest space programmes, including the multi-satellite surveillance constellation known as Istari.

Oxford Space Systems

One such company is Oxford Space Systems (OSS) – a small and medium-sized enterprise (SME) – created 11 years ago by a group of founders after having observed a gap in the market for deployable structures in space.

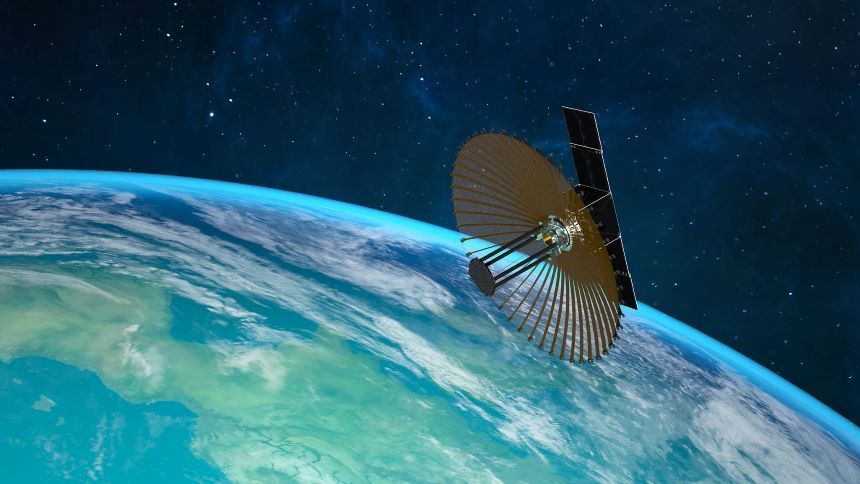

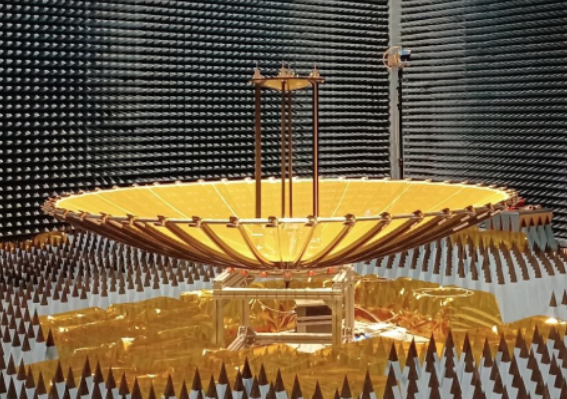

OSS has been critical to some major UK defence space programmes, including the Oberon synthetic aperture radar satellite intelligence, surveillance, and reconnaissance (ISR) programme led by Airbus.

Airbus won the Oberon contract to build two Earth observation satellites – with support from OSS – in February 2025. OSS supplied the deployable carbon-fibre Wrapped Rib Antennas (WRA).

Oxford Space Systems’ WRA. (OSS)

The company came to work on the programme after receiving funding by the National Security Strategic Investment Fund (NSSIF), Defence and Security Accelerator (DASA), and others.

Sean Sutcliffe CEO of OSS explained to DSEI Gateway how this allowed them to “take the technology from a stage where it is proven in feasibility terms, to one where we can realistically bid alongside Airbus” in competitive processes.

The NSSIF is an initiative by the UK Government and British Business Bank to fund “pioneering dual-use technologies”, helping scale innovations at pace. OSS won funding for the WRA in 2022.

Aside from defence, OSS has clients spanning the maritime and commercial air traffic control sectors.

“Obviously, for defence applications, there are often higher specifications required for that, given the nature of the missions”, Sutcliffe noted, as he discussed how OSS modified its commercial solutions for defence.

Whilst the products tend to have cross-sector utility, Sutcliffe acknowledged that “the main difference is probably the timetable that people are looking for” as defence often has long procurement cycles.

OSS has also had support from other commercial partners in developing its technology, notably Airbus, but also Surrey Satellite Technology Ltd (SSTL), another company spearheading the MoD’s dual-use agenda.

Surrey Satellite Technology Ltd

SSTL is significantly older than OSS, having launched over 74 satellites – as of March 2025 – since the company formed four decades ago.

Andrew Greenhalgh, Marketing Manager at SSTL, told DSEI Gateway that the company has generated GBP1.8 billion in revenue overall, with 80% of it coming from exports.

Originally spinning out of the University of Surrey, SSTL’s shareholders once included Elon Musk between 2005 and 2009. The company was then sold to Airbus in 2009 and has since operated as an “arms-length subsidiary”, Greenhalgh said.

SSTL has three primary business lines, he noted. They divide these into their export business, institutional business, and their relatively new defence business.

During the interview, Greenhalgh said that “we didn't have a defence business until Darren [Jones, Head of Defence Business] joined us a few years ago”, mainly because, until recently, there was less demand from the defence sector for the size of satellite produced by the company.

SSTL’s defence business has won several high-profile deals in recent years, including contracts to build UK Space Command’s Tyche and Juno Earth observation satellites.

A member of staff from SSTL working on the Tyche satellite prior to its launch under the Istari programme. (Crown Copyright 2025)

On Tyche, the company won a single-source contract from the MoD under the broader Istari ISR programme to build an Earth observation satellite after discussions with UK Space Command and the Defence Science and Technology Laboratory (Dstl).

Jones told DSEI Gateway that before Tyche, the MoD had “never owned an ISR satellite before”.

“We built and launched [Tyche] for UK Space Command last August. It is based around our Carbonite series of spacecraft and has an optical telescope within it”, he continued.

On the dual-use and broad applicability of Tyche, Jones described how “it has a few elements that are tailored towards the requirements of MoD, but fundamentally, it is our Carbonite spacecraft”.

Satellite imagery of Tampa, US, taken by UK Space Command’s Tyche satellite. (UK Space Command via SSTL)

Juno, which also forms part of the Istari programme, is due to launch in 2027. It will build on the ISR capabilities provided by Tyche, and together they will be part of “a constellation of satellites supporting [MoD] ground systems by 2031”, SSTL states.

Speaking about why SSTL moved into defence, Greenhalgh explained that “today, satellites of that size [150kg] have [now] got defence use, which they didn't traditionally have… We envisage in the future that maybe 25% to 33% of our business will be comprised of defence customers”.

A key consideration for companies seeking to enter the defence market is how much adaptation, iteration, or change is required to their existing product line. When asked about how SSTL has handled this, Jones said that “fundamentally, they're the same” with varying specifications.

Greenhalgh said that defence users would need “a higher resolution image than a commercial user” which would mainly be monitoring “agriculture, urban planning, mapping, disaster monitoring”, for example.

Commercial companies like OSS and SSTL demonstrate the role of dual-use innovation in strengthening UK defence capabilities within the burgeoning space market and amid heightened international competition in the domain.

DSEI Gateway News is part of DSEI UK and the broader Clarion Defence portfolio.

Enjoy reading this article? Click here to read more about our upcoming DSEI membership offering...

Tags

- business

- capabilities

- clarion

- commercial

- companies

- company

- defence

- dsei

- dualuse

- gateway

- innovations

- isr

- oss

- programme

- satellite

- satellites

- sector

- space

- sstl

- supporting

- systems

- technology

- tyche

- uk

- won

Providing impartial insights and news on defence, focusing on actionable opportunities.

-

While the ‘as-a-service’ model is common for software procurement, militaries are beginning to explore this approach to acquiring other military capabilities.

-

UK launches call for C-UAS solutions

15 Jan 2026 Benjamin HoweParticipation is a minimum requirement for those looking to win UK Home Office C-UAS contracts. -

Sweden to acquire air defences, drones and satellites in procurement push

15 Jan 2026 Benjamin HoweThe announcements come amid the country’s Society and Defence Annual Conference in Sälen.

)

)

)