The defence marketplace: A different approach to procurement

- Europe

- Explainer

- Procurement

As militaries turn to a new method of procurement through online defence marketplaces, DSEI Gateway takes a deep dive into the new, ‘Amazon-style’ platforms.

It is widely accepted that militaries do not procure equipment efficiently. Weighed down by bureaucracy, processes can be lengthy, pushing up lead times and hindering kit from getting to military end users quickly.

While the traditional method of acquiring kit is slow and time consuming, there is a new method appearing that aims to get equipment into the hands of soldiers at a much quicker pace – the defence marketplace.

Hosted as online portals not dissimilar, in some cases, to the likes of popular e-commerce sites, these marketplaces allow defence firms to list equipment for direct purchase by military users.

The advantages are clear, as companies get direct access to the end user, militaries get better, faster access to equipment.

Several countries are using these platforms, perhaps most notably in Ukraine where the speed of military equipment purchases is now far quicker from what is normal in many countries.

The duration of defence contracts has trended upwards in recent years according to data from Open Opps, with the average contract globally lasting 23.4 months in 2024, up from 19.1 months in 2022 – a 22.3% increase, although the data is not linear.

Additionally, 15.4% of contracts globally lasted five years or more in 2024, compared with 6.3% and 5.9% in 2024 and 2023 respectively. By contrast, the global proportion of contracts that last six months or less has dropped from 17.6% in 2023 to 12.5% in 2024. Although again this has not been linear.

It’s worth noting these lengths differ depending on the equipment being procured, with command and control systems demanding the longest average contracts at 82 months.

According to Open Opps, the increasing contract duration is perhaps due to the shift towards longer-term partnerships and multi-year contracts.

This data underscores the challenge ahead for militaries as they seek to accelerate procurement and reduce contract length. DSEI Gateway takes a look some of the biggest defence marketplaces globally that are attempting to revolutionise procurement.

Ukraine

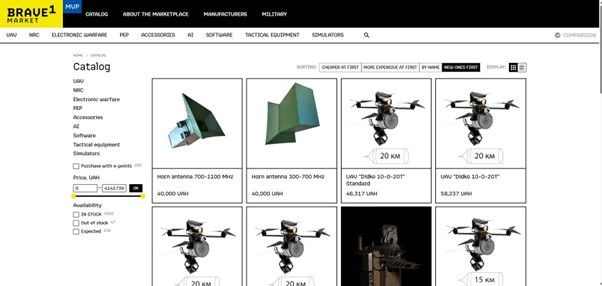

Of all the defence marketplaces, Ukraine’s Brave1 Market has perhaps caught the most attention, likely due to its aesthetic similarity with sites like Amazon and eBay.

Like most defence marketplaces, the platform is owned and operated by the government. As Arsen Zhumadilov, Director of Ukraine’s Defense Procurement Agency noted at DSEI UK, though, the state tries to play a minimal part.

The barrier for entry for companies submitting their equipment to the marketplace is “not a very high threshold”, Zhumadilov said, with the government only intervening to ensure certain regulatory requirements are met. That being said, a spot on the marketplace does not ensure success – only the firms offering the most useful solutions to Ukraine’s soldiers will make sales.

When listed on the platform, equipment is available for purchase with either Ukrainian currency or “points”, which are metered out to soldiers based on their activity in the field, incentivising them to perform.

Each military unit can also choose the exact equipment they need. This shortens acquisition timelines by removing the ‘middleman’, while also enabling units to adapt quickly – essential in a battlespace that evolves by the second. Historically, troops that are given greater decision-making authority have tended to operate more effectively.

Unsurprisingly given the how the war in Ukraine is being fought, the most common equipment on the platform are drones and drone-related accessories, such as batteries or cameras.

A screenshot taken of the Brave1 Market.

At the time of writing, the most expensive items listed on the Brave 1 Market include the “MACUVA BpAK” and “Laser Heavy” UAS, priced at UAH41.4 million (GBP749,688) and UAH10.4 million (GBP188,327) respectively. These are still low prices in the context of the military, though, pointing to a key factor in the success of the marketplace.

Once equipment has been selected for purchase by the military user, the order is then transferred to the DOT Chain Defence platform, a logistics system where purchases can be tracked and managed.

Importantly, the capabilities displayed on the Brave1 Market are mostly from small companies, giving them an opportunity to directly sell, test, and iterate their technology.

It is also worth noting that according to Open Opps, intelligence, surveillance, and reconnaissance equipment typically has the shortest contract times at an average of 19 months. Little wonder, then, that this is the most commonly sold equipment on defence marketplaces such as Brave1 Market.

UK

The UK Ministry of Defence (MoD) has developed its own defence marketplace, managed by a relatively new arm of the MoD known as Commercial X which aims to speed up procurement and the adoption of innovative technologies.

Known as the Dynamic Market, it has been designed to operate in a similar way to Ukraine’s platforms, providing a portal where defence buyers can identify necessary technology and suppliers can find procurement opportunities.

It’s a move away from traditional MoD procurement frameworks, according to the founder and head of Commercial X Dina Kakaras during a previous interview with DSEI Gateway, as it remains continuously open. Buyers can launch mini-competitions and onboard suppliers at any time, while suppliers can spot relevant opportunities before committing to rigid processes, she explained.

Although she did add that “it’s not just like a supermarket where people can buy equipment off the shelf, it’s about going out to industry with a problem or an ambition and working with them to deliver it”, Kakaras said.

US

The US Government operates several defence marketplaces as well, such as its ‘Innovation Marketplace’. This platform acts as a single access point for industry, academia, and other partners to discover the US Department of War’s (DoW) technology priorities.

The DoW state this marketplace was created as a resource to enable better communication between industry and the military, helping industry better understand the military’s priorities while giving the DoW more insight into industry projects.

Under a new Pentagon taskforce established to counter the threat of drones, the US said it also plans to launch a UAS and counter-UAS marketplace that will allow end users to shop for equipment and components, according to reporting from The War Zone.

The platform will resemble “an Amazon-like marketplace for the procurement of counter-drone technology and equipment where people can go online, look for capabilities and user feedback”, a taskforce spokesperson said.

Clearly the US is seeking to mimic the success of the Brave1 Market and DOT-Chain Defence marketplaces through this platform, an unsurprising move given how they facilitate faster procurement and acquisition.

It is therefore highly likely that other defence ministries will adopt and launch similar initiatives. Watch this space.

Tags

- 2024

- according

- amazonstyle

- approach

- brave1

- contracts

- data

- deep

- defence

- different

- dive

- dsei

- equipment

- gateway

- industry

- market

- marketplace

- marketplaces

- method

- militaries

- military

- months

- new

- online

- perhaps

- platform

- platforms

- procurement

- soldiers

- takes

- through

- turn

- ukraine

Providing impartial insights and news on defence, focusing on actionable opportunities.

-

Featured New

The future of procurement: why as-a-service is gaining ground

16 Jan 2026 Olivia SavageWhile the ‘as-a-service’ model is common for software procurement, militaries are beginning to explore this approach to acquiring other military capabilities. -

Participation is a minimum requirement for those looking to win UK Home Office C-UAS contracts.

-

New

Sweden to acquire air defences, drones and satellites in procurement push

15 Jan 2026 Benjamin HoweThe announcements come amid the country’s Society and Defence Annual Conference in Sälen.

)

)

)